Forecasts of High Penetration of Electric Vehicles are Based on Flawed Calculations

Anas Alhajji

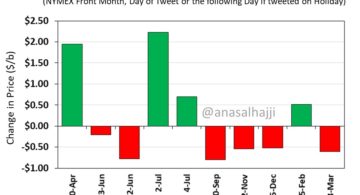

Before I start, read my pinned tweet at @anasalhajji

These are tweets that I expanded on here as a response to some very bullish reports on the penetration of electric vehicles issued by some investment banks. The calculation that favors electric vehicles over other cars are totally flawed, hence the whole prediction is flawed. Please note that Tesla is excluded from the comments below for reasons that will be obvious as you read through the comments.

- In the calculations, they assumed a resale value for electric vehicles that are three times the actual resale value in the market. It seems they are using Tesla’s resale value and applying it to all other EVs. Once adjustment is made, using their own formulas, the cost of ICE vehicles becomes way lower and better than electric vehicles (again, Tesla in not included).

- The irony here is that ICE is cheaper despite their use of fuel prices in Europe, which is way more expensive than in the US. Once fuel prices in the US are used, ICE vehicles are way cheaper than EVs (again, using their own formulas). But seriously, why are they using European fuel prices, one of the most expensive in the world, to predict EVs penetration worldwide, including in the US and China?

- They also assumed a low cost of batteries per kwh. They used what the industry aspires to, not what is the cost now or what it could be practically in the coming years. Once the current cost, or even slightly lower, is added, the whole picture changes against EVs. One might say that they are looking at the future and it is logical to use the lower cost. In this case, see 7, 8, and 10 below. They are also part of the future.

- From pure economics point of view, the real cost of the electric vehicle should be accounted for, not the cost to the buyer. Aside from the subsidy, auto companies, such as Fiat, are selling their electric vehicles for a price that is lower than the cost by about $20,000. Once the real cost is used, electric vehicles become prohibitively expensive when compared to the equivalent ICE cars. In other words, why Fiat will produce millions and millions of cars where it loses $20,000 on each?

- One disturbing point is the assumption of ride sharing as one of the main drivers for adoption of EVs. Let us face it, ride sharing will reduce the cost of the ride regardless whether the car is ICE or EV. So why all of sudden people change behavior and start sharing rides, only to boost the use of EVs? One fact is clear, taxis may shift from Ice to EVs, but that is it. This should not increase ride sharing just because the taxi is electric! The idea of an explosion in ride sharing is just that, and idea. Owners of private cars will not give up their private cars to share a car or share a ride. Otherwise, they would do it today with ICE vehicles.

- The comparison between a heavy duty vehicle like a taxi and private car to show ride sharing is better is also flawed. Those who drive 10,000 miles per year do not need a car with 100 kwh battery. A taxi needs it, but they ignored battery degradation, which means the number of assumed cycles to replace the battery will not lead to the assumed mileage. Once adjustment is made, the difference in cost is not as large as claimed.

- Autonomous vehicles are still decades away from being used on a large scale. Even then the idea of ride sharing is still far-fetched.

- Worth noting, an ICE van that transport a family of 5-7 is still more efficient than any EV exists on the roads today. Ride sharing at its best!

- For some reason they assumed an explosion is mileage driven. There is no logic for such explosion except the idea that such massive increase in miles driven will lead to massive increase in EVs, but not ICE. What a logic!

- Once you add the tax to compensate for the gasoline tax, ICE cost of ownership and the cost per ride is way lower than electric vehicles, using their own formulas!

- They ignored the impact of lower demand for gasoline on growth of EVs. As gasoline prices decrease with the increase in the number of EVs, the numbers in the formula used change in favor of ICE vehicles, leading to a lower number of EVs than predicted in these reports. In other words, the competition between ICE vehicles and EVs is dynamic, not static.

- Looking at various reports, I have not seen any report that focuses on the availability of resources for the hundreds of millions of electric vehicles they predict that will be on the roads in the coming decades. Do we have enough lithium? Cobalt? Nickel? Ok, at what price? The forecasts that we will have hundreds of millions of electric vehicles without proving that we have enough resources at reasonable prices make the forecast an opinion, just like any opinion out there. The assumption that the cost will decrease as demand increases might be true for technology, but not for limited resources such as lithium, cobalt, and nickel.

- Ignoring policy makers’ reaction in the future is another problem. In fact, it is clear that the reaction in the future is NOT favorable to EVs and that is why was ignored. EVs will be REGULATED and TAXED just like others. Matters related to disposal of batteries and recycling will be heavily REGULATED and the cost will be higher. Politicians’ concern about the concentration of lithium and cobalt deposits in handful of countries will result in some actions that will limit growth of EVs and increase their costs. Political events and labor strike in the countries that produce lithium, cobalt, and nickel will force politicians and policy maker to react the same way they reacted to the oil embargo and other political crises in the oil-producing countries. If you think the Middle East is unstable and bloody, wait until you meet the Democratic Republic of Congo!

Those who say we need electric vehicles so we do not waste money defending oil-producing countries will find the US and Europe spending money defending the lithium, cobalt, and nickel producing countries and heavily involved in their domestic politics.

The number of electric vehicles will continue to increase over the coming decades and will reduce the growth of global oil demand, but predictions of hundreds of millions of EVs before 2030 is far-fetched.

Comment