The Impact of Decertifying the Iran Nuclear Deal on the Oil Markets

Anas Alhajji

President Trump may not certify to Congress the Iran nuclear agreement. If this happens, three possible scenarios:

a. Decertify but no recommendation for action: no impact on the oil market (most likely)

b. Decertify and recommend modification: No impact on the oil market

c. Decertify, revoke, and recommend sanctions: The impact in this case is listed below from a set of tweets I posted recently @anasalhajji

1- If US returns same old sanctions on Iran, oil exports will decline. Any decline in oil production is minor.

2- We will end up with a significant gap in production between secondary sources and direct. communications in OPEC data in both Iran and Iraq.

3- Iran might resort to its old strategy: sell oil as if it were Iraqi oil, build massive floating storage, and use more oil in power generation and export oil embedded in electricity.

4- More oil and products will be sent to countries like Syria and Venezuela.

5- Countries that will play every one includes China, India, and Egypt. They would receive Iranian oil anyway. Oh, do not forget France!

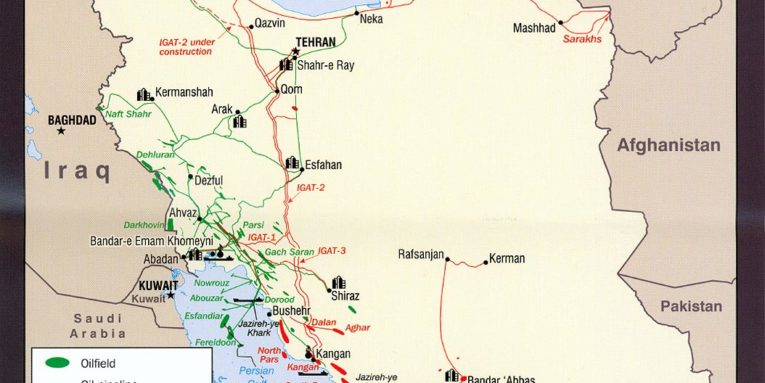

6- The impact of return of sanctions on oil prices is measured in the short and medium terms. We WILL NOT HAVE A SPIKE! About an average of $3 premium.

7- The price premium is NOT a political premium. It is just the impact of losing some exports.

8- However, sanctions will have a significant impact on the plans to increase oil production capacity in Iran. In a sense, the impact in the long run on the oil market could be higher than the impact in eth short run.

9- What Iran accomplished energy-wise during the previous sanctions was truly amazing and a case study in energy policy.

10- The switch from gasoline to CNG and the building of small refineries in a short period worth studying.

11- This chart explains some of the points above:

Comment