Surprise: Trump’s Oil Tweets Do Not Matter!

Anas Alhajji @anasalhajji

March 28, 2019

A quick look at the 12 oil-related tweets that President Trump tweeted in 2018 and 2019 reveals some interesting facts. While it is difficult to make a conclusion on their impact on the oil market, the general feeling among analysts is that they are keeping a cap on oil prices, regardless of the daily fluctuations. It seems that the “Trump Band” replaced the “Shale Band.”

Worth noting that almost all Trump tweets were associated with news that oil prices will increase to $100, oil prices will continue to rise, or after OPEC meetings. Therefore, it is hard to know whether his tweets were a reaction to prevailing prices or the expectations of higher oil prices. In this case, his tweets are a “preemptive strike” to prevent oil prices from increasing to the expected levels he heard on TV.

Looking at this morning tweet, there was a story on CNBC last night where experts predicted that the oil rally will continue in the next two quarters. There was also another story on Bloomberg TV on “substantial oil rally.” February 25 tweet came in at 6:58 AM on Monday morning, after CNBC story talked about oil prices reaching 2019 high, experts talking about supply disruption from Venezuela, and a bullish report from Goldman Sachs. The December 5 tweet was related to OPEC’s December meeting in which it decided to cut production.

The story of the other tweets is the same: reaction to expectations of a major oil rally or OPEC decision. In this case, trump tweets are about preventing the perceived sharp increases in oil prices, not about the prevailing oil prices.

Regardless, one fact stands out: The President of the United States is using his might to manipulate oil prices. While people can debate his motivation, especially that the US cannot be energy dominant with low oil prices, I argue in this post in the link below that the President is obsessed with fear of high oil prices from the late 1970s and early 1980s, then by developments in the early 1990s. What he is saying now is a repeat of what he had said a long time ago.

Here is the link: Is Trump an Anti-Oil Zealot?

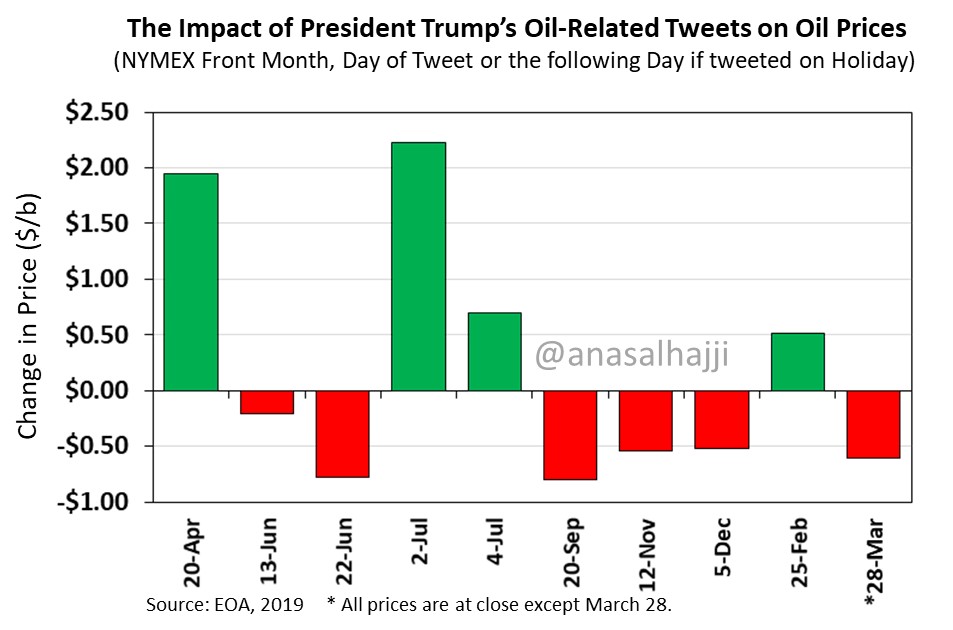

A review of Trump 10 oil-related tweets and daily prices reveals the following (two tweets in November were omitted because they were bragging tweets):

- Assuming all changes in oil prices are related to Trump’s tweets, the negative impact (lower price) on WTI spot was more than the impact on Brent Spot (7/10 vs 5/10)

- The negative impact on spot prices in the US was relatively higher than the impact of NYMEX futures (7/10 vs 6/10)

- The net impact of all Trump tweets on NYMEX front month was +$0.26/b. Yes, positive! But when looking at spot, here is an interesting result: positive on WTI (+$0.16/b) and negative Brent (-$0.28/b). But this result should be taken with a grain of salt because of the sharp decline in Brent prices on February 25th.

- The impact was along the forward curve except today’s tweet, the impact was mostly limited to the front month (and the impact might die down toward the end of the day). The question is: are Trump tweets losing their impact? Will we end up with “cry wolf” syndrome?

The Figure below shows the impact of Trump tweets on US NYMEX front month oil prices

Worth noting that the above are just observations and Not scientific analysis. A more rigorous analysis should focus on the shape and changes in forward curves after the tweets while excluding the impact of other variables. They should also examines statistically whether Trump’s tweets are creating a cap on oil prices. (A good exercise for PHD students and new academics)

Conclusion

The Trump’s oil tweets impact on oil prices is unclear. All differences above are within a small range where some of it or most of it can be explained by factors other than Trump’s tweet such as changes in inventories or unplanned disruptions. Therefore, we cannot discount the idea that Trump’s tweets are in response to fear of very high prices every time he heard experts on TV predicting such an increase, not in response to prevailing prices.

Regardless, Trump’s tweets, and the large reception they receive in certain quarters indicate that OPEC messaging is NOT working. Bragging about helping shale and the US oil industry is the wrong message! Regardless, why repeat a fact that everyone knows?

Here you go, I started talking about Trump and I ended up blaming OPEC!

Comment