How Does the Saudi Math of the Oil Price War Work?

Anas Alhajji

I have been discussing this issue with several colleagues in the last two days. There are two general mistakes out there: the use of production instead of exports and comparing prices to pre-OPEC+ meetings. The correct way is to use exports (actually supply) to be able to calculate export revenues and to use the oil price that would prevail in case of no cooperation in the light of the impact of the coronavirus.

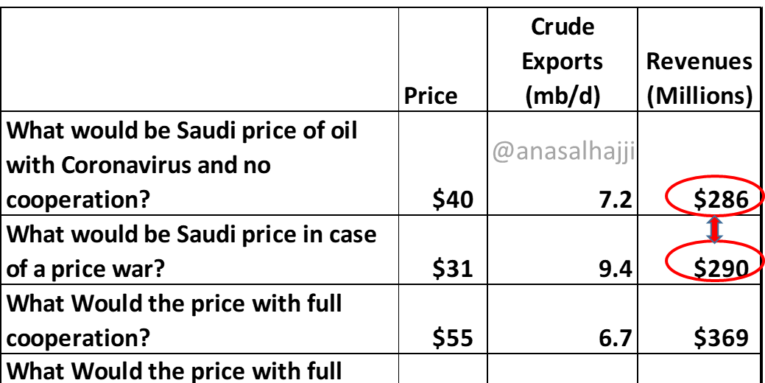

The Table below shows the proper calculations. You may not agree with the numbers. Choose your own reasonable numbers and redo the calculations. The average Saudi oil price would decline to about $40/b in case of no cooperation and with the Coronavirus impact as we know it. Keeping exports the same, Saudi export revenues would be $286 million per day. This is the anchor that we should compare all other numbers to, not the $50/b that prevailed before the meetings.

With a price war, the average Saudi price declines to about $31/b (The OSP: Brent – the average discount to various destinations). Exports (supply) increase to 9.4 mb/d (they might increase to 9.7). Here we see that increased supplies compensated for the decline in prices and Saudi revenues remain virtually the same.

Benefits of Cooperation

The bottom two lines in the Table show the benefits of cooperation. Full cooperation under Coronavirus increases revenues by about $79 million per day to $369 million. (All other countries benefit too)

The same full cooperation without Cornovirus would increase prices to about $75/b. Revenues would jump above $500 million.

Bottom Line

Even if you do not agree with the above numbers, one main conclusion is clear: Higher exports compensate for most of the losses from low prices in the case of a price war. In the example above, there are no financial losses.

Russia can increase production by about 300 kbd at maximum. To match the Saudi price in Europe, Urals have to be sold at $25-$26/b. The math is clear: Russia loses revenues under the current circumstances, even with an increase in exports.

The hope is for those countries to return to full cooperation. It is good for the population of the two countries, and good for all other oil-producing countries, including the US and Canada.

Doesn’t it cost money to produce a barrel? So since they are producing more oil wouldn’t they pay more to do it? Like it would cost them $5-10/BO to produce the oil. Probably doesn’t change your answer here, but would reduce the amount of income in the lower price scenario.Jor

This is an investment that is already based in the past. That is why they keep spare capacity.

The math does not include physical premium and cost of freight (which isnt as significant now to Aramco).