Impact of Hurricanes on the Oil Industry in 7 Charts

Charts will be updated weekly until end of November.

Anas Alhajji

Main Takeaways

- Every hurricane is unique in its impact on the oil industry.

- The final impact of any hurricane on oil prices is the net of supply disruption and demand destruction

- Industry recovery depends mostly on the amount of damage and logistics. Floods make logistics a nightmare. They also complicate refining recovery.

- Post-shale world is different from pre-shale world

Oil Production Takeaways

- Given the location of platforms and pipelines, the hurricane’s path is detrimental

- Also, the strength of hurricanes determine the length of the shut-ins

- In pre-shale era, production disruption was limited to the Gulf of Mexico. As we have seen with Harvey, the impact extended to the onshore Eagle Ford, in the post shale era.

- Will production recovery from Harvey be like Isidore or like Ike or Katrina? Most likely it will be close that of Isidore.

Figure (1)

US Crude oil Production (Selected Years, mb/d)

2017 is measured on the right side

Source: EIA, 2017 and EOA 2017

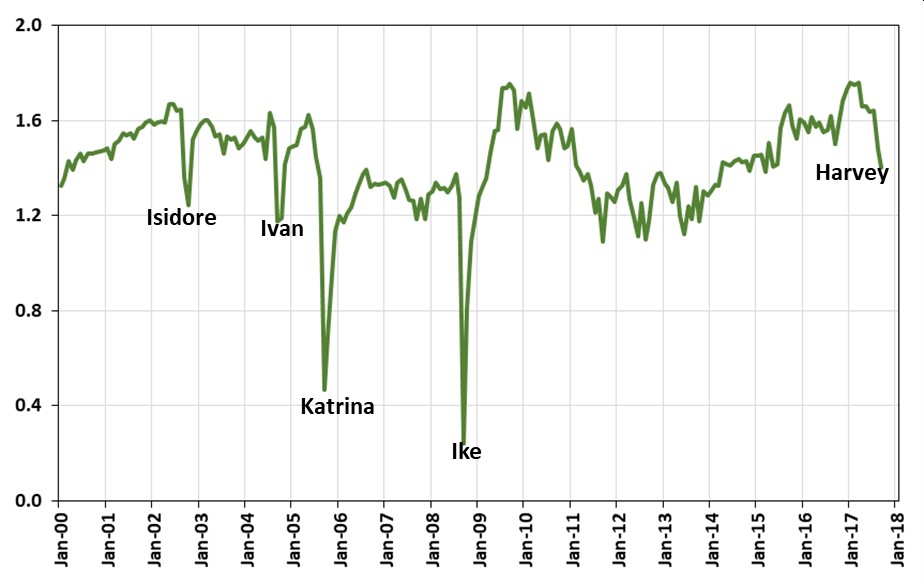

Figure (2)

Crude Oil Production in US Gulf of Mexico (mb/d)

Source: EIA, 2017 and EOA 2017

Figure (3)

Eagle Ford Crude Oil Production (mb/d) Source: EIA, 2017 and EOA 2017

Source: EIA, 2017 and EOA 2017

Oil Demand Takeaways

Oil demand declines during hurricanes. The impact depends on what is in the path of the hurricane: refineries, energy installations, major population centers, major airports, etc.

- Refinery shut-ins and damages reduce demand for crude

- Halt of transportation systems (ground, rail, sea and air) reduces demand for oil products

- Halt of economic activities reduces demand for oil products

The above three factors that reduce demand applies to Harvey. The last two applies to hurricane Irma. From initial reports, hurricane Harvey has a larger impact on demand than hurricanes Katrina and Ike. Once we add hurricane Irma, the destruction to demand for oil in the US in September could be unprecedented.

Figure (4)

PADD 3 Oil Demand (mb/d) Source: EIA, 2017, EOA, 2017

Source: EIA, 2017, EOA, 2017

Refining Takeaways

Shut-ins and damages to refineries reduce crude oil inputs (they back out crude).

- While the decline in refinery net crude inputs that resulted from Harvey may not be as large as others, time to recover to full capacity might be as long as that of Katrina or longer.

Figure (5)

Refinery Net Inputs of Crude Oil (mb/d)

Source: EIA, 2017 and EOA 2017

Oil Inventories Takeaways

- Unlike previous major hurricanes, Harvey increased crude oil stocks.

- One explanation is that in post shale era, disruptions to imports from the Gulf of Mexico are limited as imports are almost half pre-shale era.

- Given the experience of Katrina and Ike, and given the significant refinery shut-ins, Harvey is expected to reduce gasoline inventories to the 5 year average quickly.

- Note that total gasoline stocks (not shown) do not give the same results as finished gasoline in Figure (7). Hurricanes back out blending components the same way they back out crude, making the trend in total gasoline stocks different from that of finished gasoline.

Figure (6)

Crude Oil Stocks (mb)

Source: EIA, 2017 and EOA 2017

Figure (7)

Finished Gasoline Stocks*

Source: EIA, 2017 and EOA 2017

*The dotted line shows an approximate trend without hurricanes

Conclusion

Harvey (and Irma) are bearish in the short term, very bullish in the medium term, and bullish long term. The demand destruction from both is significant and larger than the supply disruption. Luckily, it is temporary. The rebuilding and replacement of cars and equipment should increase the demand for oil above normal levels for several months.

The most important impact of Harvey is that it will eliminate the persistent surplus in gasoline inventories, which cast its shadow on crude prices. Since the US is a large exporter of products, importers of US petroleum products suffered too. The return of refineries to full capacity will not mean a build in gasoline, but it definitely means continuous crude draw in the coming months. end

Comment